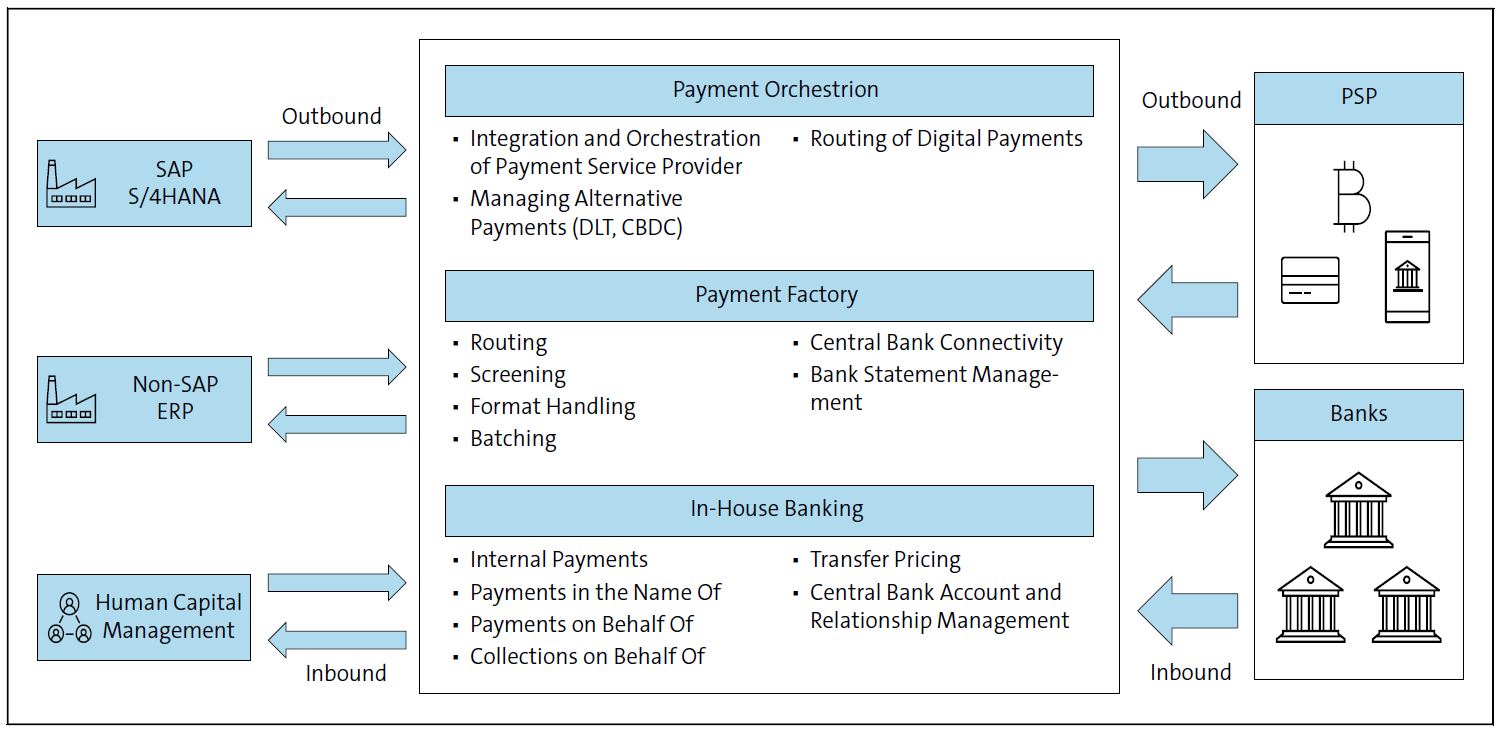

A payment factory is a centralized approach to managing corporate payment processes across multiple systems, entities, and banks in SAP S/4HANA. By consolidating payment execution, bank connectivity, and control mechanisms into a single platform, a payment factory reduces operational complexity, increases transparency, and strengthens governance over company-wide payment flows. Understanding what a payment factory is, how it differs from related concepts such as in-house banking and payment orchestration, and when its implementation is justified is essential for organizations aiming to modernize treasury and cash management operations. In an increasingly regulated and digital environment, the payment factory thus becomes a strategic component to harmonize company-wide payment processes and prepare them for future requirements. The main idea behind a payment Factory is to connect multiple systems into one centralized payment platform. This central system serves as the hub for payment orchestration (see figure below), where all payment service providers and funding sources are integrated. Instead of establishing separate connections from each underlying system to banks or payment providers, only the payment factory needs to maintain those external connections—significantly simplifying the architecture and reducing operational complexity. When outbound payment files are received, the payment factory acts as a smart processing layer: It identifies the nature of each payment—whether it’s a PINO, POBO, or COBO payment, an internal transfer, or another type defined in this book—and applies appropriate checks and treatment for this payment. These include validations, fraud detection, sanctions screening, and even payment optimization, such as identifying opportunities to convert cross-border payments into more efficient local transfers. Once verified, the system processes the payment and routes it to the appropriate bank or payment service provider. In return, the payment factory receives bank statements and payment acknowledgements, which it also processes and integrates into the system. By consolidating these tasks into a single platform, the payment factory enables a unified, transparent, and efficient payment landscape—providing a single point of control and complete visibility for reporting and reconciliation. A payment factory is fundamentally always as individual as the company itself and can be modularly structured. Just like every company is unique, not all services of a comprehensive payment factory are always necessary. Let’s look at the key components of a payment factory: In a group with numerous subsidiaries and cost centers, extensive intragroup services arise, which culminate in intercompany invoicing processes and intragroup payments. In the worst-case scenario, these intragroup payments are processed through external banks, leading to fees and potentially also to foreign exchange (FX) conversion costs. This is where an in-house bank can provide support. An in-house bank, in its broadest definition, functions as a centralized financial management vehicle in which the group's treasury acts as the primary provider of diverse financial services to its operating units, maintaining an arm’s-length distance in transactions. The services provided by an in-house bank include central cash and liquidity management, which ensures optimal use of financial resources across the corporation. It also centralizes the management of bank relationships, thereby streamlining interactions and potentially enhancing negotiation leverage with banking partners. A payment factory acts as a centralized payment processing unit within a corporation, designed to enhance the efficiency and effectiveness of handling financial transactions. It is primarily responsible for the execution of external payments on behalf of (POBO) subsidiaries, thereby relieving them from the complexities involved in managing individual payment processes. This centralized approach allows for the standardization and automation of payment flows, streamlining operations and reducing manual intervention. By controlling external bank connections, the payment factory ensures secure, efficient, and consistent interactions with financial institutions, maintaining a standardized protocol across the organization's banking activities. The focus of a payment factory is predominantly on cost efficiency and process standardization, aiming to achieve significant reductions in transaction costs through economies of scale while minimizing risks and errors associated with decentralized payment processes. This centralization not only improves the financial control and oversight within the corporation but also enhances liquidity management and provides greater strategic support for treasury operations. Payment orchestration refers to the centralized management and control of various payment providers, payment systems, and alternative digital currencies within a unified platform. By integrating multiple payment service providers (PSPs), a payment orchestrator enables centralized and flexible control of these PSPs during transaction processing. Transactions can be dynamically orchestrated based on criteria such as cost, execution method, or geographical requirements. In addition to supporting PSP orchestration, a modern payment orchestration solution also includes the integration of digital currencies such as Bitcoin, stablecoins, or central bank digital currencies. Cryptocurrencies can be processed either directly through blockchain transactions or via specialized payment gateways like BitPay or Lightning Network. Furthermore, payment orchestration offers centralized reporting and analytics functions to monitor transaction flows in real time and optimize payment strategy. The table below provides a comprehensive overview of three key concepts in corporate financial management: in-house banking, the payment factory, and payment orchestration. Each of these financial strategies offers unique advantages in terms of efficiency, cost management, and strategic control over the financial operations within a company. By centralizing various functions, they streamline processes and enhance the effectiveness of treasury activities across complex organizational structures. In-House Banking: Internal Corporate Bank Payment Factory: Centralized Payment Processing Unit Payment Orchestration: Payment Service Providers and Payment Method Orchestration The implementation of individual solutions, such as in-house banking or an entire payment factory, can be driven by a variety of factors. Prior to undertaking such initiatives, it is advisable to conduct a thorough analysis of your current business processes. This provides an overview of areas where a payment factory could deliver significant value. It is rare for transaction costs alone to serve as the primary motivator for establishing a payment factory, especially as these costs—particularly for cross-border payments—have markedly declined in recent years. Today, the primary drivers for implementing a payment factory are the enhanced security of payment transactions and the ability to orchestrate payment flows across the entire group. This also encompasses the group-wide management of liquidity, offering a unified and strategic approach. A fully developed payment factory serves as a central organizational model, delivering greater control over global bank relationship management, payment processes, and banking connectivity. This centralized approach creates a powerful lever for optimizing efficiency and ensuring transparency across financial operations. The following key design questions should be considered when designing a comprehensive payment factory for an in-house bank: Some countries impose restrictions on capital export, impacting cash pooling and payment processes like POBO. The affected countries and payment types vary globally. For precise details on restrictions in each country, consulting the local central bank and a bank advisor is recommended. Some banks, like BNP and its Cash Management Atlas, provide public information as a helpful guide. For more information, visit this site. Similarly, for a payment factory, you must consider the following questions: And finally, for payment orchestration: In SAP S/4HANA, a payment factory provides a structured framework for centralizing payment execution, bank connectivity, and control across a corporate group. While transaction cost reduction is no longer the primary driver, improved security, standardized processes, and group-wide orchestration of payment flows are key reasons organizations adopt this model. By carefully defining scope, regulatory constraints, system integrations, and service components—such as in-house banking and payment orchestration—companies can design a payment factory that delivers transparency, control, and long-term strategic value for treasury and finance operations. Editor’s note: This post has been adapted from sections of the books Payment and Bank Communication Management with SAP by Adrian Matys and Jean-Michele Szczecina. Adrian is an SAP finance professional with more than 10 years of experience. Jean-Michele is a subject matter expert in the areas of payments and cash management at Zanders. This post was originally published 1/2026.

In-House Bank

Payment Factory Function

Payment Orchestration

Management of internal (virtual) accounts

Execution of external payments for subsidiaries

Optimization of customer payments in e-commerce

Intercompany payments and financing

Standardization and automation of payment flows

Smart routing across multiple payment service providers

Internal interest calculation and cash pooling

Control of external bank connections

Flexible integration of payment methods and channels

Focus: Liquidity and financing within the group

Focus: Cost efficiency and process standardization

Focus: Conversion optimization and customer experience

Cash Management Restrictions

Conclusion

English (US) ·

English (US) ·